The Best Strategy To Use For Medicare Graham

The Best Strategy To Use For Medicare Graham

Blog Article

Things about Medicare Graham

Table of ContentsExcitement About Medicare GrahamExcitement About Medicare GrahamHow Medicare Graham can Save You Time, Stress, and Money.The Only Guide for Medicare GrahamThe Greatest Guide To Medicare Graham

An individual that joins any one of these policies can give power of attorney to a relied on person or caregiver in case they become unable to handle their events. This suggests that the individual with power of attorney can administer the policy in support of the plan owner and watch their medical information.

Getting My Medicare Graham To Work

Be sure that you comprehend the fringe benefits and any kind of benefits (or liberties) that you may lose. You may intend to think about: If you can transform your existing medical professionals If your medications are covered under the plan's drug list formulary (if prescription drug coverage is provided) The month-to-month costs The expense of insurance coverage.

What added solutions are used (i.e. precautionary treatment, vision, dental, health and wellness club subscription) Any therapies you require that aren't covered by the plan If you wish to enlist in a Medicare Benefit plan, you must: Be eligible for Medicare Be enrolled in both Medicare Component A and Medicare Part B (you can examine this by referring to your red, white, and blue Medicare card) Live within the strategy's service area (which is based on the area you live innot your state of home) Not have end-stage kidney disease (ESRD) There are a couple of times during the year that you might be eligible to alter your Medicare Advantage (MA) strategy: The happens each year from October 15-December 7.

Your new protection will start the very first of the month after you make the button. If you need to alter your MA plan beyond the conventional registration periods described over, you may be eligible for an Unique Enrollment Duration (SEP) for these certifying events: Relocating outside your plan's coverage area New Medicare or Component D plans are readily available because of a relocate to a new permanent area Lately released from jail Your plan is not renewing its agreement with the Centers for Medicare & Medicaid Solutions (CMS) or will quit offering advantages in your location at the end of the year CMS may also develop SEPs for certain "extraordinary problems" such as: If you make an MA enrollment demand into or out of an employer-sponsored MA strategy If you wish to disenroll from an MA strategy in order to enroll in the Program of Extensive Take Care Of the Elderly (RATE).

Little Known Facts About Medicare Graham.

resident and have ended up being "lawfully present" as a "competent non-citizen" without a waiting duration in the USA To confirm if you're eligible for a SEP, Medicare South Florida.call us. Medicare.

Third, take into consideration any medical solutions you might require, such as verifying your present physicians and specialists approve Medicare or locating insurance coverage while away from home. Check out regarding her latest blog the insurance companies you're taking into consideration.

The 6-Minute Rule for Medicare Graham

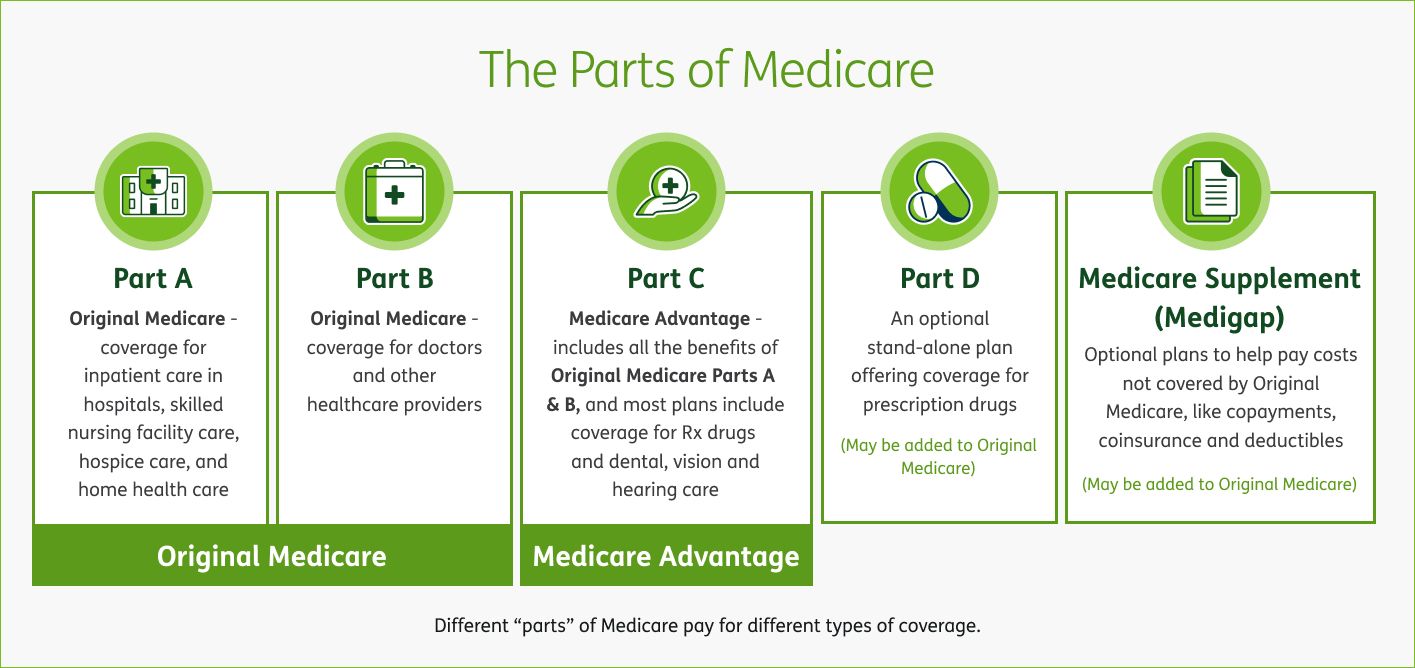

To pick the appropriate insurance coverage for you, it's vital to comprehend the fundamentals regarding Medicare - Medicare Lake Worth Beach. We have actually collected every little thing you require to find out about Medicare, so you can pick the plan that ideal fits your demands. Let's walk you via the procedure of how to examine if a Medicare supplement plan may be ideal for you.

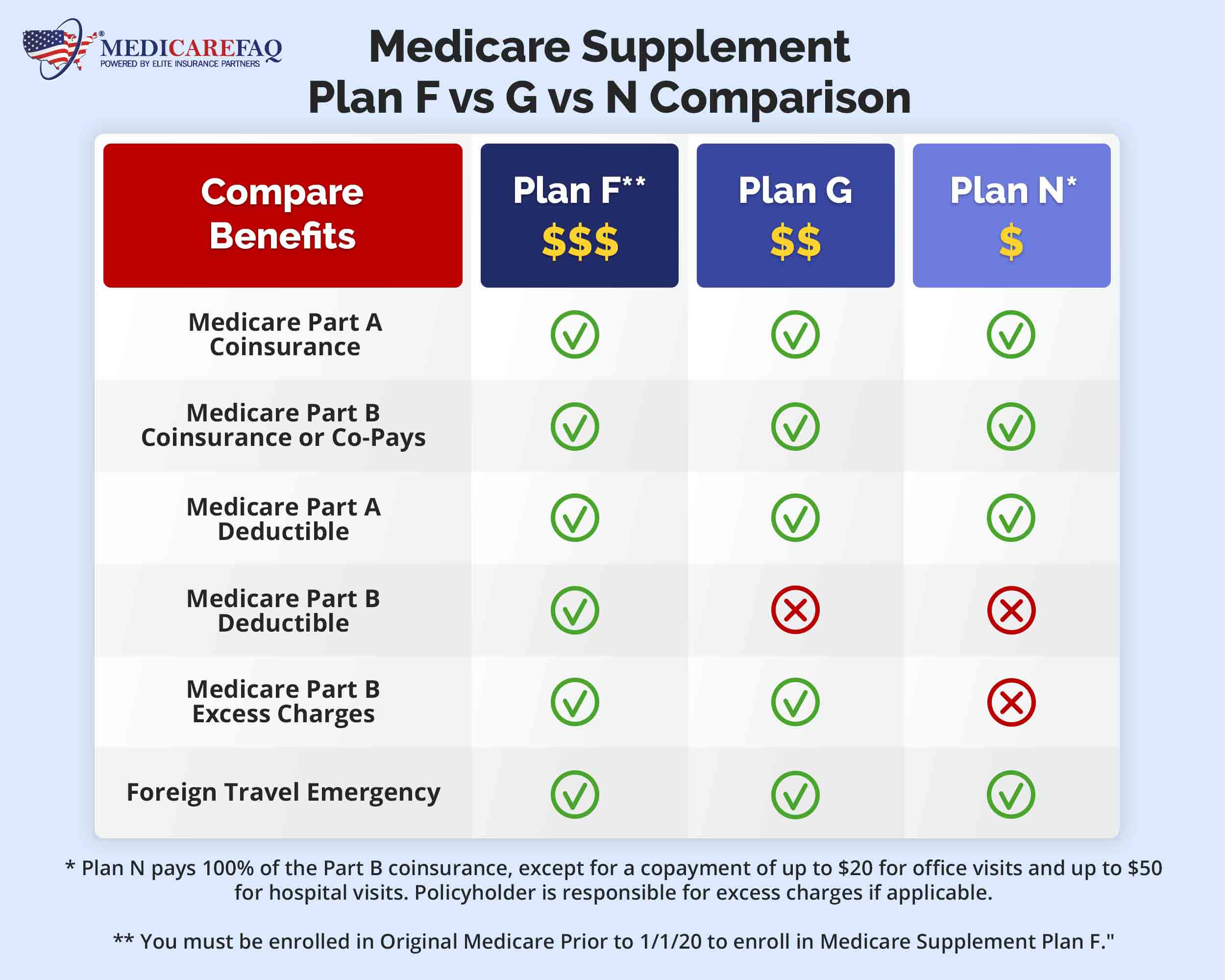

Medicare supplement plans are simplified right into courses AN. This classification makes it less complicated to compare a number of supplemental Medicare plan kinds and pick one that best fits your needs. While the fundamental advantages of each kind of Medicare supplement insurance policy plan are uniform by provider, costs can range insurance coverage companies.: Along with your Medicare supplement strategy, you can choose to purchase extra insurance coverage, such as a prescription medicine strategy (Part D) and oral and vision coverage, to help meet your certain demands.

You can find an equilibrium in between the plan's expense and its coverage. High-deductible strategies supply low costs, but you may have to pay more out of pocket.

The smart Trick of Medicare Graham That Nobody is Discussing

For example, some strategies cover international traveling emergency situations, while others omit them. List the medical services you most value or may need and ensure the plan you select addresses those requirements. Personal insurance policy firms supply Medicare supplement strategies, and it's advisable to read the fine print and compare the value different insurance firms offer.

It's always a good idea to speak with representatives of the insurance coverage carriers you're considering. And, when evaluating particular Medicare supplement insurance coverage carriers, research their durability, checked out customer reviews, and get a sense of the brand's reputation in the insurance coverage area. Whether you're switching over Medicare supplement plans or buying the first time, there are a few things to think about *.

Report this page